free cash flow yield plus growth

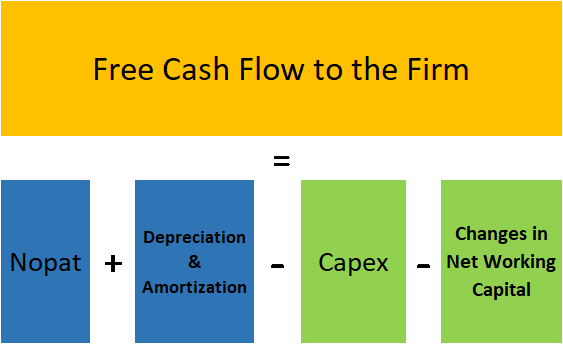

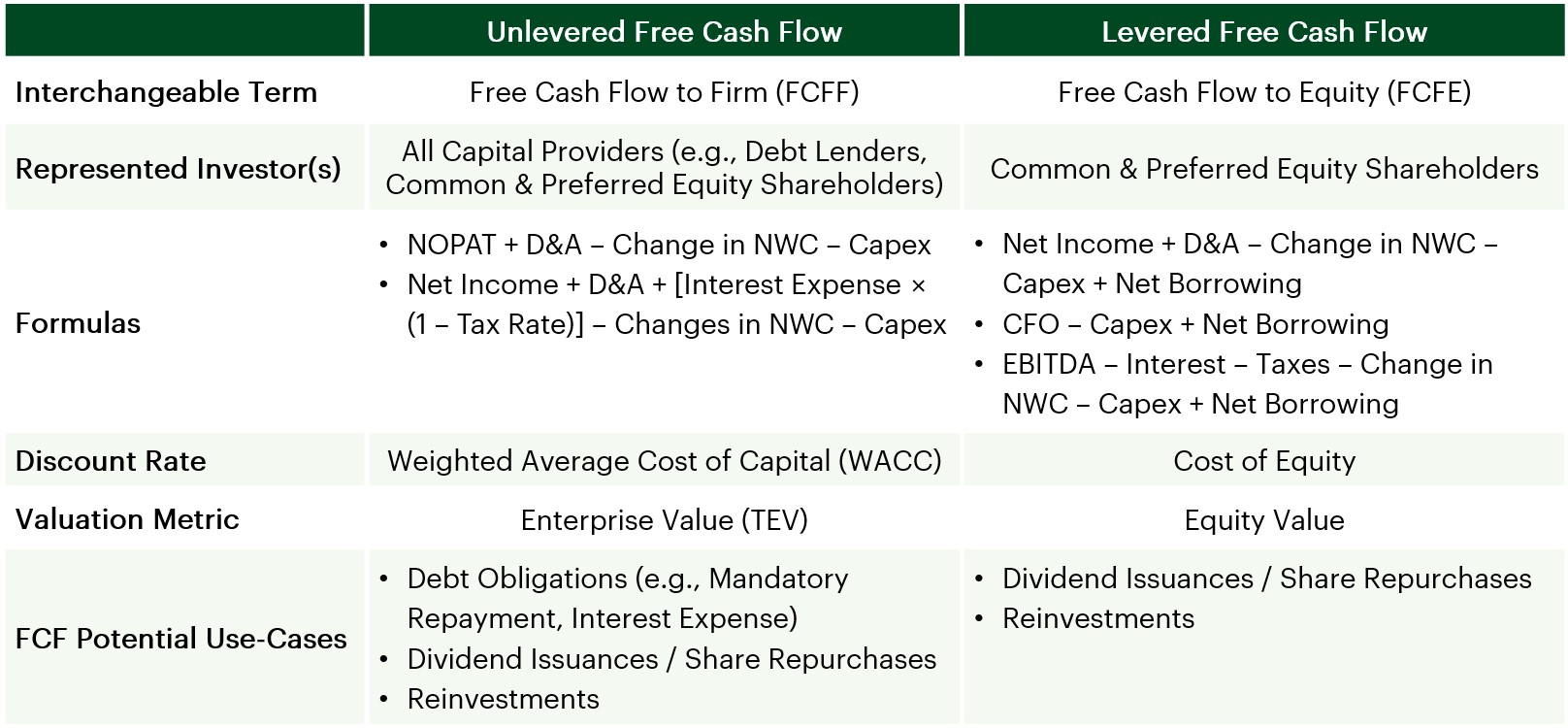

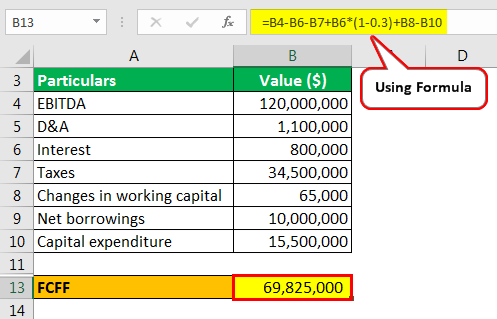

Of those using discounted free cash flow models FCFF models are. The ratio is calculated by taking.

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share.

. 2022e free cash flow sensitivities 3 Assumes 85 WTI 400Henry Hub NGL realizations at 40 of WTIand a mid -single digit current tax rate. FCF Cash from Operations Capital Expenditure. This can be substantially different than EPS since it is real money as opposed to earnings which can be somewhat theoretical.

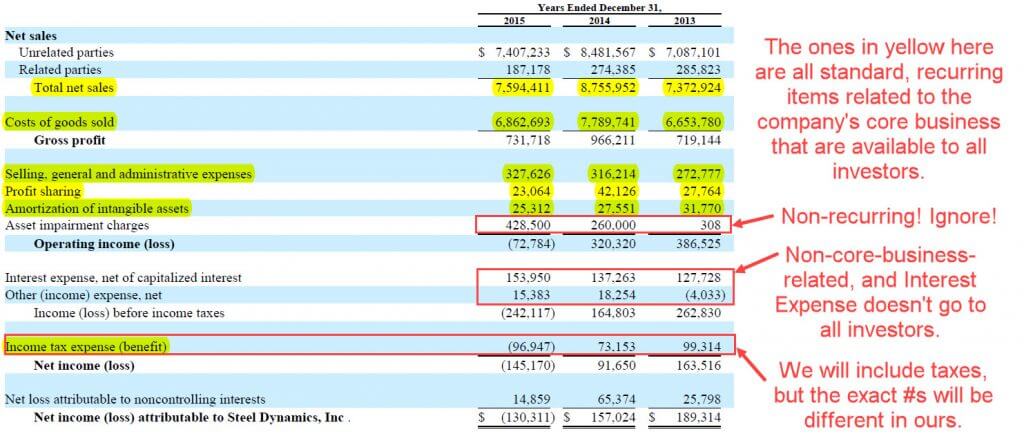

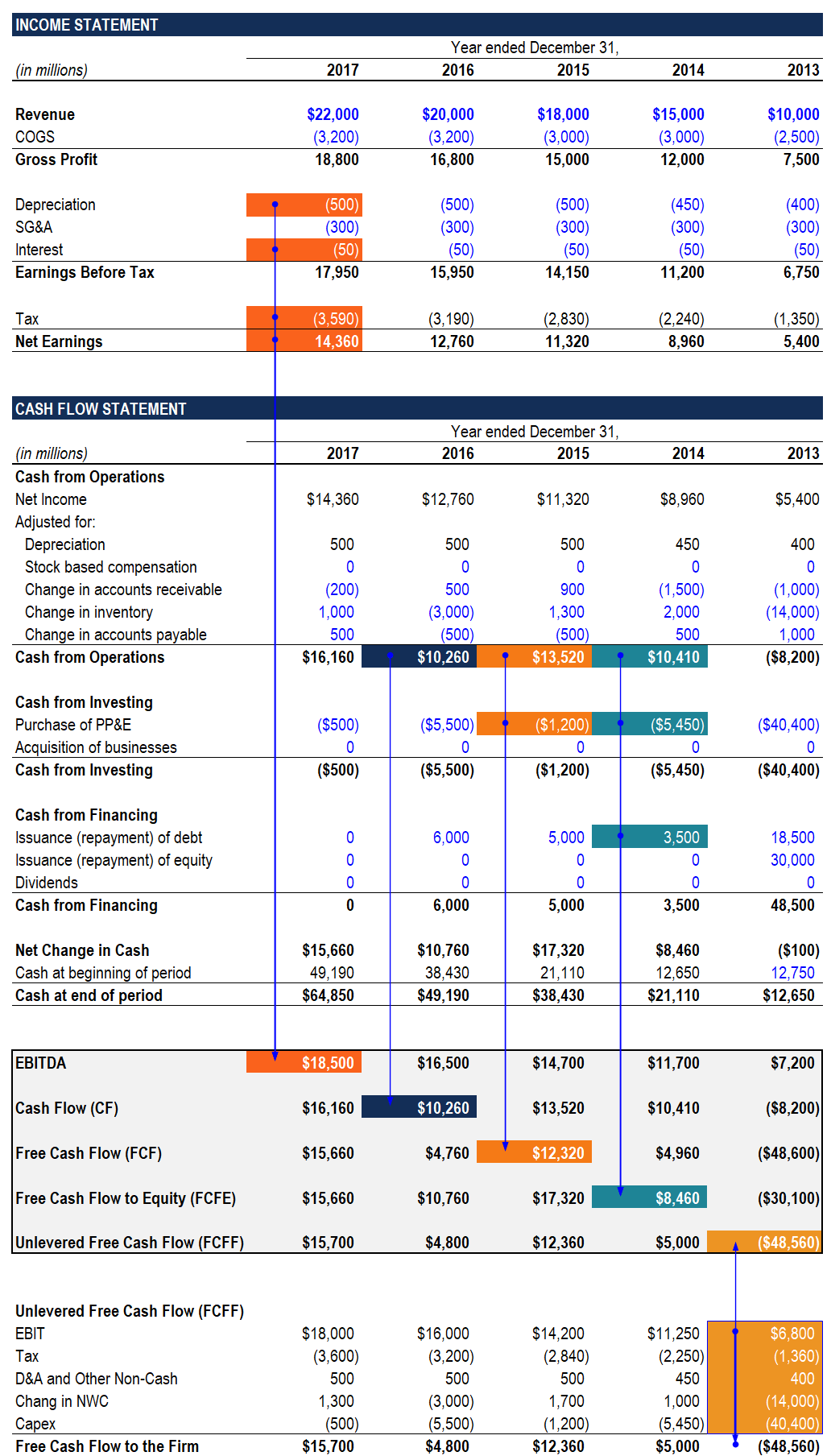

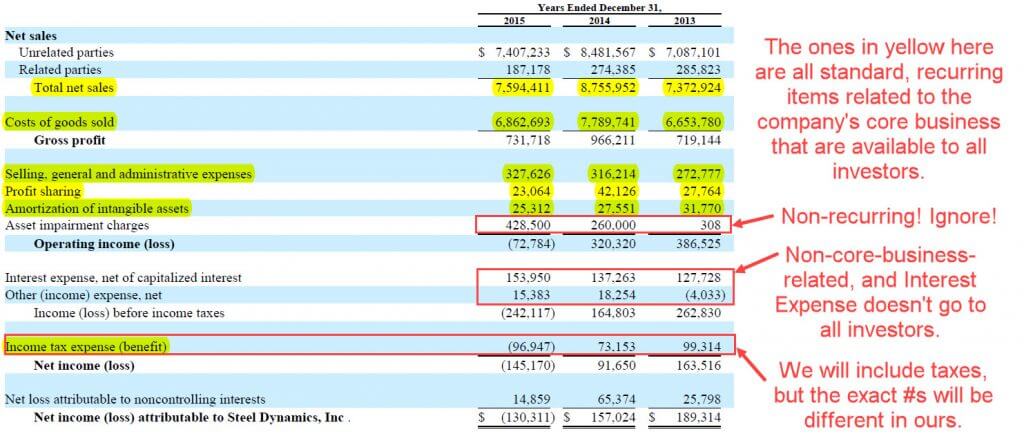

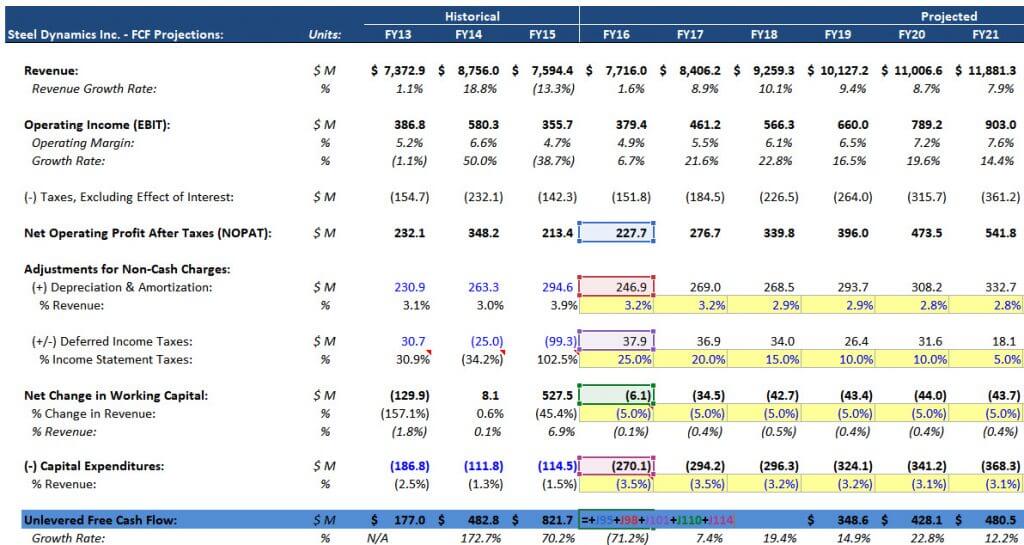

This figure is also referred to as operating cash Then subtract capital expenditure which is money required to sustain business operations from its value. To make sure you have a thorough understanding of each type please read CFIs Cash Flow Comparision Guide The Ultimate Cash Flow Guide EBITDA CF FCF FCFE FCFF This is the ultimate Cash Flow Guide to understand the. The price to economic book value PEBV ratio for COWZ is 14 which is less than the 18 for IUSV holdings and nearly half the 2.

Free cash flow is a determinant of dividends and share repurchase. CVS operates more than 9900 drug stores and over a thousand walk-in medical clinics. Free Cash Flow Yield 16932 Billion 21516 Billion Free Cash Flow Yield 786.

Once this is also subtracted it leaves estimated free cash flow of circa 155b and thus a very high near 15 free cash flow yield on their current market capitalization of approximately 107b. For the growth part of the Forward Rate of Return calculation GuruFocus uses the 5-year average growth rate of EBITDA per share as the growth rate and the. Once you calculate the Terminal Value then find the present value of the Terminal Value.

Divided by the stock price so thats your free cash flow yield plus the annual rate of growth in that cash flow while still making such payments. To calculate FCF get the value of operational cash flows from your companys financial statement. COWZs free cash flow yield of 4 is double IUSV and SPY at 2.

The free cash flow yield is around 5 percent but the free cash flow growth rate is 20 to 25 percent easy. Assuming an inflation rate of 25 the forward rate of return on an investment in the SP 500 is about 65 today 25 free cash flow yield plus 15 real growth plus 25 inflation. Free cash flow yield offers investors or stockholders a better measure of a companys fundamental performance than the widely used PE ratio.

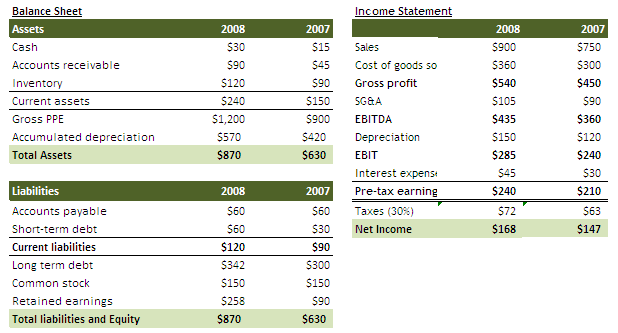

Excel-based Investment Research Solution for Serious. How to Compute Free Cash Flow. We could also look at the free cash flow yield in relation to its trailing-twelve-month numbers or TTM to get the latest yield.

Analysts forecast 885 higher earnings this year along with significant FCF growth. It has a free cash flow yield of 114 compared to 43 for the SP 500 and 49 for the Russell 3000 value index. When using discounted cash flow analysis 205 of analysts use a residual income approach 351 use a dividend discount model and 869 use a discounted free cash flow model.

For example if you paid 100000 for a. Accordingly the Energy sectors free cash flow has led it to offer. Investors who wish to employ the best fundamental.

People sometimes describe this as free cash flow yield Cash on Cash Yield is a different measurement often used to evaluate real estate investments. Its the amount of cash flow available to buy back stock pay dividends acquire other businesses etc. The Operating Cash Flow Growth Rate aka Cash Flow From Operations growth rate is the long term rate of growth of operating cash the money that is actually coming into the bank from business operations.

Marathon Oil is an attractive oil and gas play with a 121 dividend yield and a forward PE below 10x. The number that really matters isnt free cash flow. Hopefully this free YouTube video has helped shed some light on the various types of cash flow how to calculate them and what they mean.

See the formula below. The formula for Terminal value using Free Cash Flow to Equity is FCFF 2022 x 1growth Keg The growth rate is the perpetuity growth of Free Cash Flow to Equity. Thats calculated as a free cash flow yield of around 7 plus projected free cash flow growth of 12-15.

3 2 Estimated oil price needed to fund all capital and operating expenditures in 2022. In our model we have assumed this growth rate to be 3. Thats the ratio of free cash flow to market cap.

2021 Positioned for an attractive free cash flow yield in 2022. Now to calculate the free cash flow yield we divide the free cash flow by the market cap of the company. Instead of market capitalization it uses the price you paid for an investment as the denominator.

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Free Cash Flow Meaning Examples What Is Fcf In Valuation

How To Calculate Free Cash Flow Excel Examples

Free Cash Flow Fcf Most Important Metric In Finance Valuation

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

How To Calculate Free Cash Flow Excel Examples

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

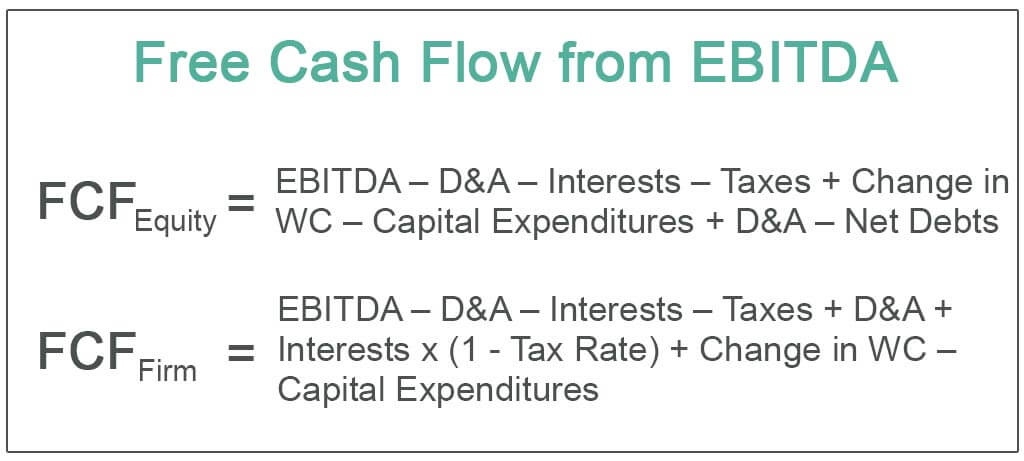

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

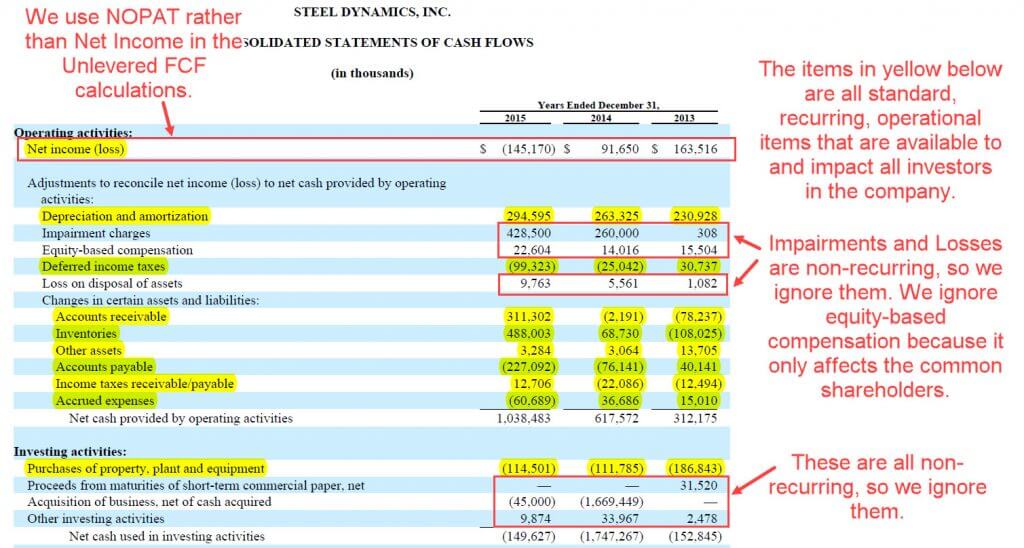

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Dividend Stocks Vs Etfs Get The Highest Returns And Safety Dividend Investing Money Life Hacks Investing

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator